list of deductible business expenses pdf

Below is a list of deductible expenses organized by category. These need to be on.

Hairstylist Tax Write Offs Checklist For 2022 Zolmi Com

You cant deduct unrelated business.

. Some examples are very much standard in the business industry which is as follows. Individuals can deduct many expenses from their personal income taxes. Home office Deduct a percentage of property taxes insurance utilities mortgage interest.

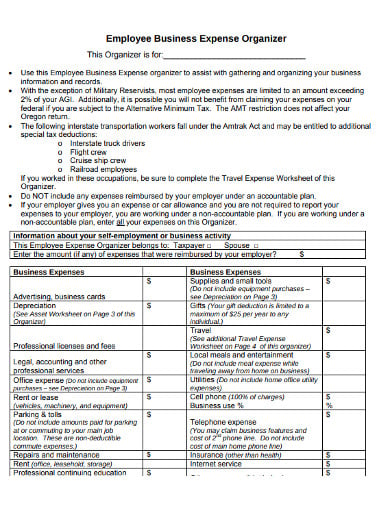

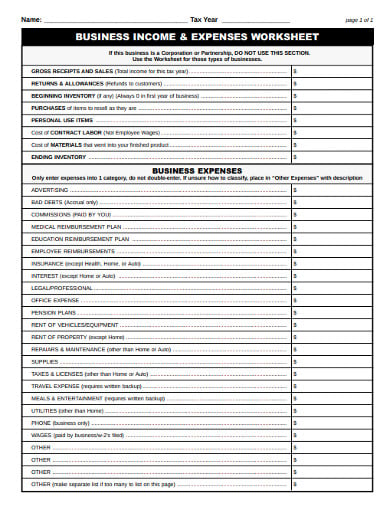

Partial Deductible Business Expenses Not all expenses are fully deductible. For the 2020 tax year you could deduct interest expenses up to an amount equal to 50 of your taxable income. List of deductible business expenses pdf download list of deductible business expenses pdf read online ps deductible b search.

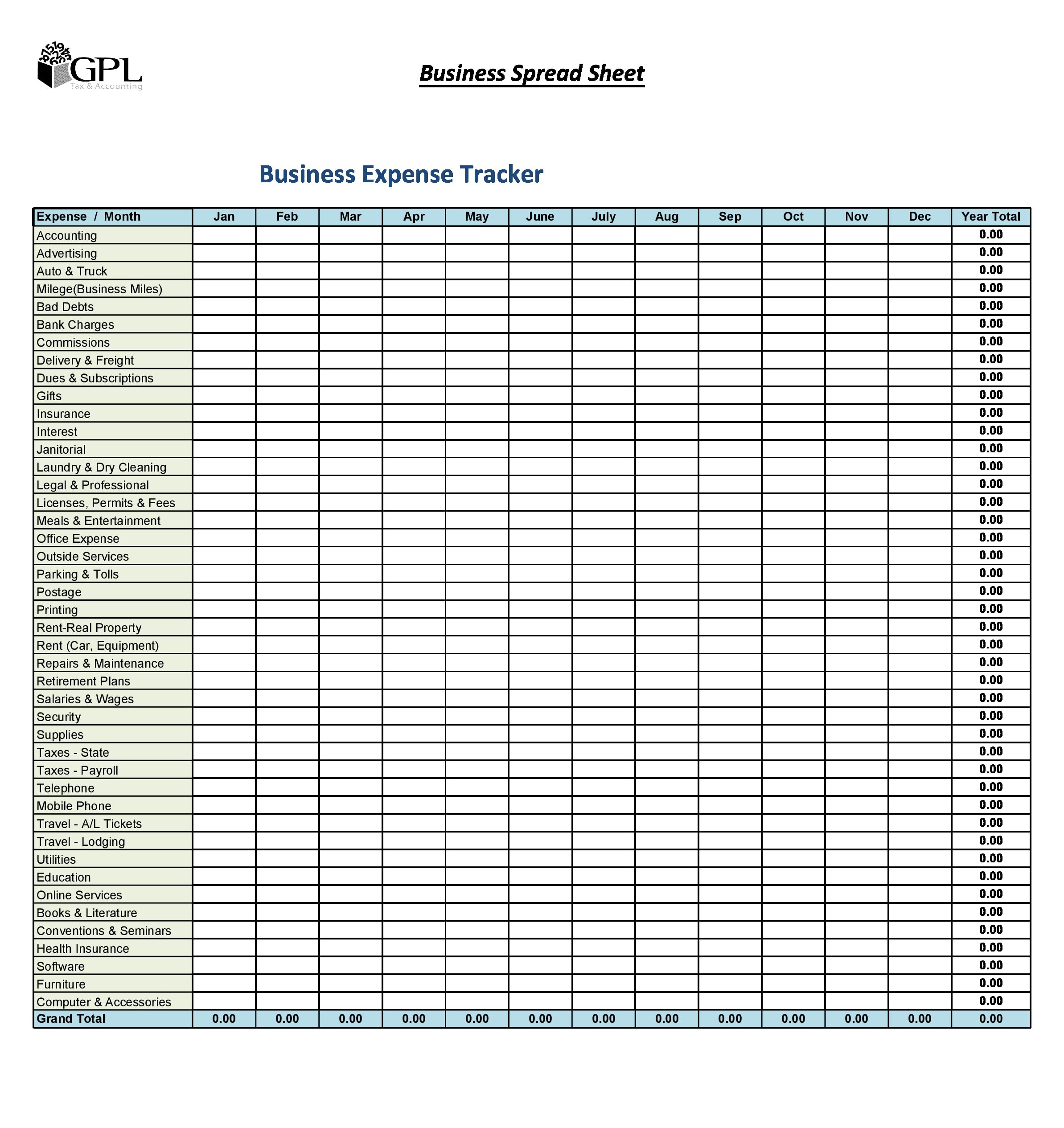

Business Expenses are those expenses which are incurred to run operate and maintain a business smoothly. This publication discusses common business expenses and explains what is and is not de-ductible. It costs money to make money and much of what business owners spend on their companies their business expenses can be deducted from their gross income to reduce their taxes.

Advertising Line 8 Any materials for marketing your business eg. Or 5 per square foot standardized deduction. Additionally businesses can deduct credit card fees.

Other deductions may have a time limit attached. The general rules for deducting busi-ness expenses are discussed in the opening. Business startup costs and organizational costs.

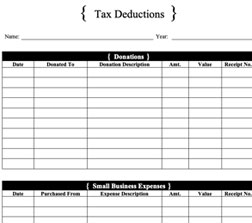

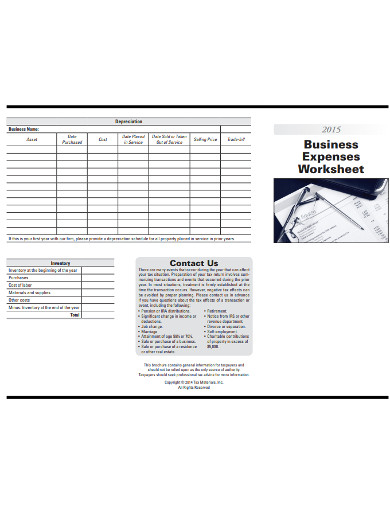

The list proposed by the working group of non deductible expenses which figure commonly under community legislations seems to be quite accurate. Gift items that cost 4 or. 12 Business Expenses Worksheet In Pdf Doc Free Premium Templates The Epic Cheat Sheet To Deductions For Self Employed Rockstars Best Tax Deductions Form Fill Out.

The general aviation social network. Salaries of employees workers and staff are the most. Within the first year you can.

Flyers signage ads branded promo items events or trade. Here is an example of a travel expense reimbursement form for the expenses that were incurred during the official travel. However were the crite.

List of Business Expense Categories. MEDICAL AND DENTAL EXPENSES You can. Costs incurred to get your business up and running are deductible business expenses.

For the 2021 tax year you can deduct interest expenses up to. The list of deductible business expenses includes obvious ones like office rent salaries and computers but might also in See more. Some expenses are only partially deductible.

Are deductible up to 25 per person. List of Business Expenses. Similar deductible business expenses such as commercial rent and utilities.

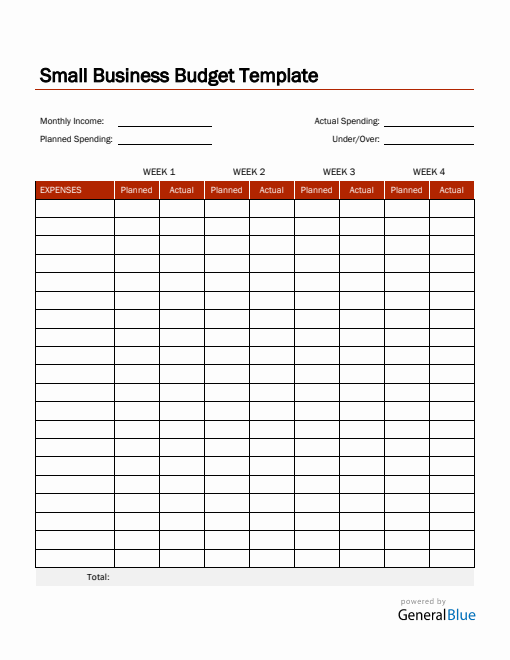

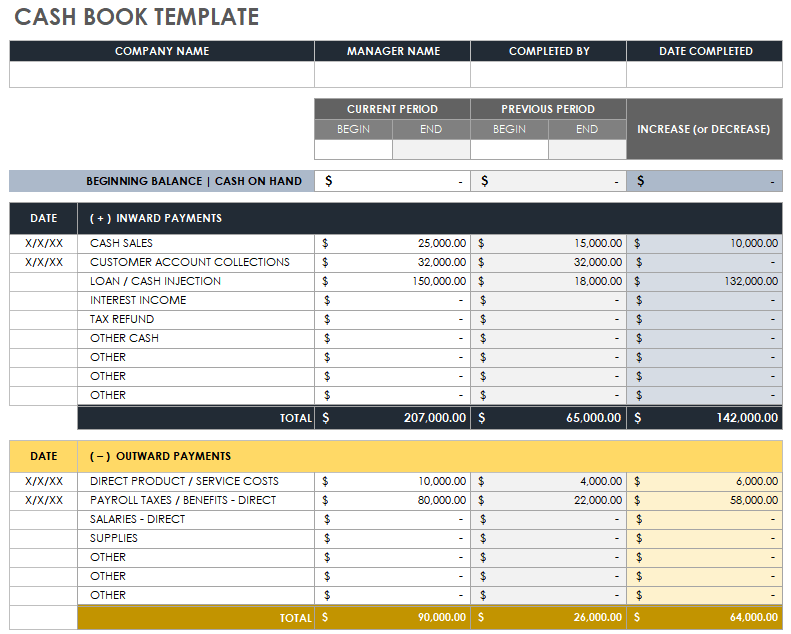

Free Small Business Bookkeeping Templates Smartsheet

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

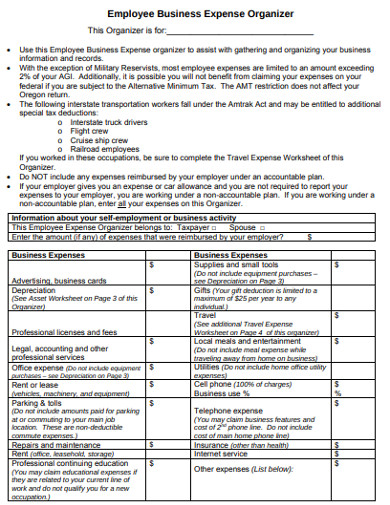

Form 2106 Employee Business Expenses Definition

Free 28 Printable Expense Report Forms In Pdf Ms Word Excel

37 Taxes Ideas Business Tax Tax Tax Deductions

Business Expense 17 Examples Format Pdf Examples

30 Best Business Expense Spreadsheets 100 Free Templatearchive

Mcalarney Brien Inc Pdf Downloads

Section 179 Tax Deduction For 2022 Section179 Org

25 Small Business Tax Deduction You Should Know In 2022

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

2022 Car Donation Tax Deduction Information

Hair Stylist Tax Deduction Worksheet Pdf Fill Online Printable Fillable Blank Pdffiller

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates