sales tax permit austin texas

Share ideas online about improving Austin Participate in the City Sign up for email updates. Request a Duplicate Permit.

Post Image For What Is A Sales And Use Tax Permit Tax Permit Storage Auctions

Get Licening for my Hays County.

. LLC DBA Sales Tax Permit For LLC in Austin TX 33415578701Sales Tax Permit For LLC LLC. In addition tax may be due on items purchased tax free for sale through the business. The minimum combined 2022 sales tax rate for Austin Texas is.

Ad Fill out a simple online application now and receive yours in under 5 days. Apply for a Sales Tax Permit Online. Select Request a Duplicate Sales Tax Permit.

In TX you may also need a sales tax ID AKA sellers permit if you sell merchandise that is taxable. Depending on the type of business where youre doing business and other specific. Confirm Your Mailing Address.

Also called a TXsellers permit state id wholesale resale reseller certificate. Any business in Texas that plans to sell or lease tangible goods or personal property needs a Sales and Use Tax Permit. Learn more about obtaining sales tax permits and paying your sales and use.

The Texas sales tax rate is currently. Austin collects the maximum legal local sales tax. This is the total of state county and city sales tax rates.

The County sales tax rate is. You will need to pay an application fee when you apply for a Texas Sales Tax Permit and you will receive your permit 2-3 weeks after filing your application. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Who Needs a Texas Sales Use Tax Permit. Resale Permit Austin Texas PepRetail Trade Author Book Sales in Austin Hays County TX. Use tax is due on the purchase price of unsold items that were diverted to personal use used in the.

An Austin Texas Sales Tax Permit can only be obtained through an authorized government agency. Local taxing jurisdictions cities counties special. Permit Status Active - The taxpayer has an active sales tax permit and is eligible to issue a resale certificate to their suppliers to purchase qualifying items tax-free for resale.

Sales and Use Tax Applications. You must obtain a Texas sales and use tax permit if you are an individual partnership corporation or other legal entity engaged in business in Texas and you. Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used.

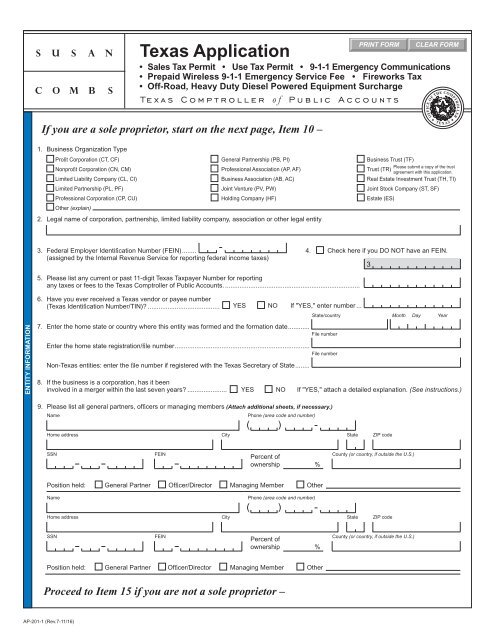

AP-201 Texas Application for Sales and Use Tax Permit PDF AP-215 Texas Online Tax Registration Signature Form. The 825 sales tax rate in Austin. Taxpayer ID is an eleven digit number assigned by the Texas Comptroller.

You will need to apply using form AP-201 Texas Application PDF. Email the application to salesapplicationscpatexasgov or fax the application to 512-936-0010.

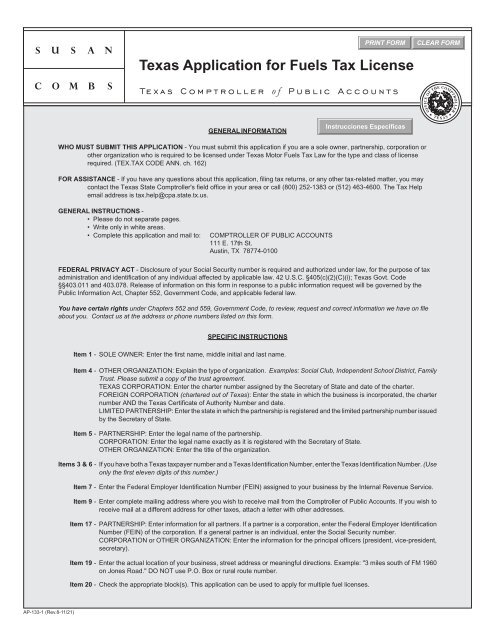

Ap 133 Texas Application For Fuels Tax License Texas Comptroller

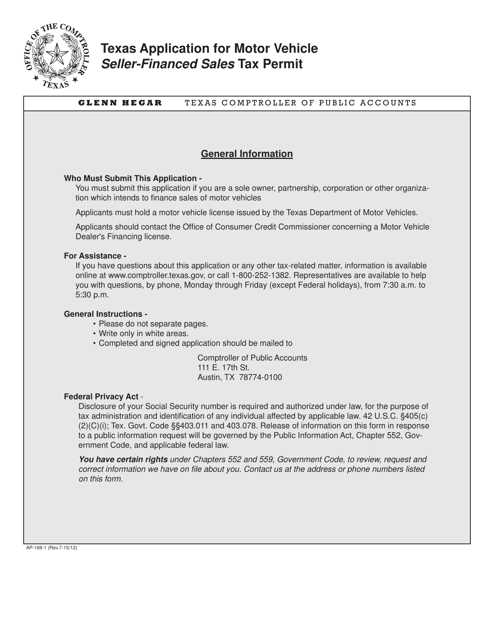

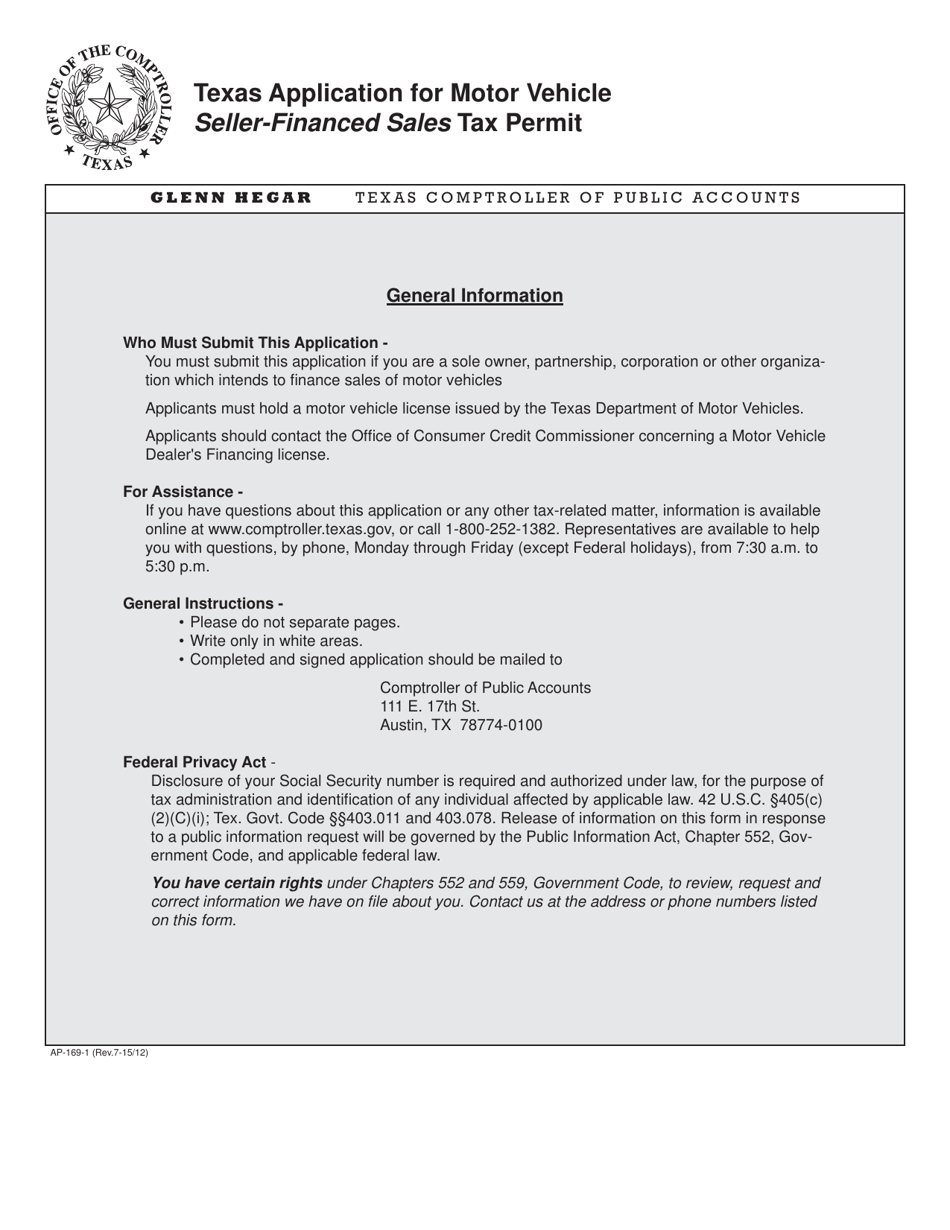

Form Ap 169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller Financed Sales Tax Permit Texas Templateroller

Understanding Your Home Energy Bill Electricity Bill One Bedroom Apartment Lottery Numbers

How To File And Pay Sales Tax In Texas Taxvalet

How To Get A Resale Certificate In Texas Startingyourbusiness Com

How To File And Pay Sales Tax In Texas Taxvalet

How To Apply For The Texas Sales Tax Permit 2020 Step By Step Youtube

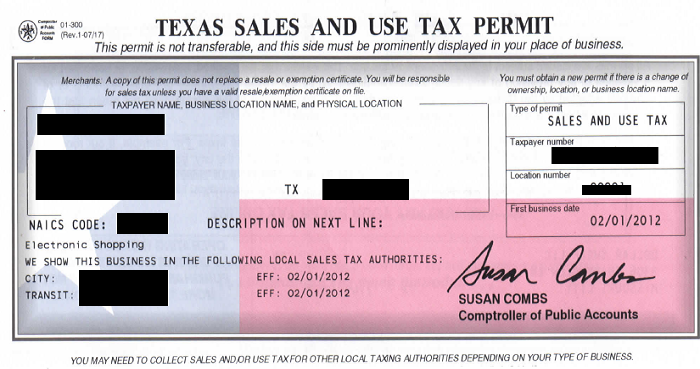

Texas Sales And Use Tax Permit Texas Tax Consulting Group

Do I Need A Seller S Permit For My Texas Business Legalzoom Com

What Is A Sales And Use Tax Permit

How To Register For A Sales Tax Permit In Texas Taxjar

Texas Sales Tax Small Business Guide Truic

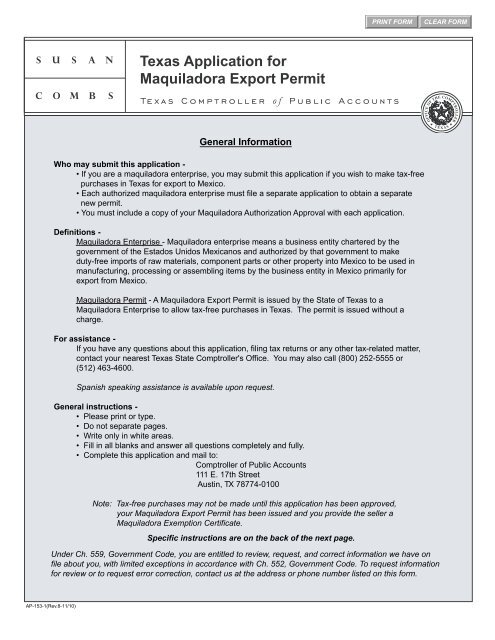

Ap 153 Texas Application For Maquiladora Export Permit

How To File And Pay Sales Tax In Texas Taxvalet

Ap 201 Texas Application For Texas Sales And Use Tax Permit

How To File And Pay Sales Tax In Texas Taxvalet

Form Ap 169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller Financed Sales Tax Permit Texas Templateroller